The purpose of the Kelly Criterion is to help you define the optimal stake amount based on your available funds and the edge you believe you have over the bookmaker. Kelly criterion staking approach aims to maximize your winning and protect your capital in losing runs.

Kelly Criterion mathematical equation takes into account your bankroll, your own calculated winning probability of the outcome you are betting on, and the odds available from the bookmaker. A simplified definition would describe this method as decreasing the wager when losing and increasing it when winning.

As you can expect that money management approach will result in a roller-coaster ride of your account balance so you should definitely have yourself mentally prepared for higher volatility in your results.

Note for Kelly to work, you must have a positive edge over the bookmaker if you do not have an advantage over the bookmaker, the Kelly Criterion recommends not to place a bet. Furthermore, Kelly criterion can be practically used only for single outcome bets, and it isn’t suitable for accumulator bets.

How to Calculate Kelly Criterion

We know that not everyone loves maths, but if you want to be successful with your sports betting, we advise you to remind yourself some basic equations. Below is the formula used to calculate the Kelly Criterion stake size.

[(Your probability * by the odds available) – 1] divided by (odds available -1)

As you can see, it does not look that complicated in fact, it is quite straight forward. Let’s use the above formula and apply it in real life example and see how it works.

Kelly Criterion Example

If the above formula does not help you that much to understand how it works, here is an illustrated example of the Kelly criterion in practice. You have just decided that you will treat your sport betting as an investment and dedicated £10 000 specifically to betting. You can afford to lose these funds, and that will not have an impact on your lifestyle.

You have read this and several other articles observing the efficiency of the different staking plans and decided to stick with using the Kelly criterion as your preferred money management approach.

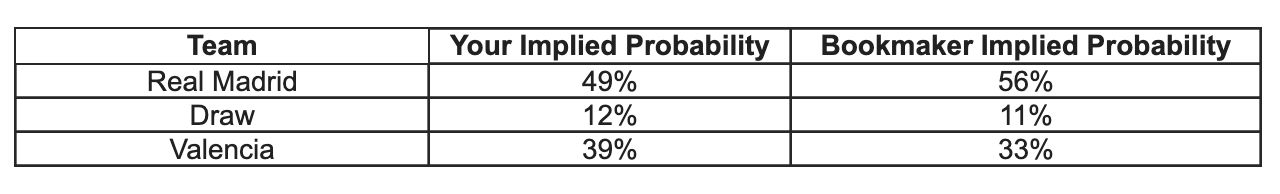

Let’s assume that there is a football game between Real Madrid and Valencia. You did your analysis and created odds of 2.56 ( 14 / 9 in fractional ) for Valencia to win the game, which means that the implied probability for Valencia to win is 39%.

You have used Betting.com odds comparison to shop around for the best odds and came across with a leading bookmaker offering you odds 3 (implied probability 33.3% ) for Valencia to win. Clearly, in this scenario, you are having a value bet and should place a bet as you believe that the chances for Valencia to beat Real Madrid are higher than what the bookmakers are offering.

In order to define the Kelly Criterion suggested stake, we will follow the formula from the previous paragraph:

[ (0.39 * 3 ) – 1 ]/( 3 – 1 ) = [ (0.39 * 3) – 1 ]/2 = [(1.17 – 1)]/2 = 0.17/2 = 0.085

0.085 * 100 = 8.5%

Meaning you should risk 8.5% from your betting bank and back Valencia to beat Real Madrid.

Since you have already done some additional reading around money management strategies and you are indeed treating your betting as an investment, you would not risk 8.5% from your entire bankroll in one single event as that is too aggressive and you could wipe your betting bank in just a few losing bets.

In order to normalize the risk and protect our betting bankroll, we would apply a discount factor which is also known as fractional Kelly criterion.

If the above calculation still looks complicated do not worry we developed a fully automated Kelly Criterion calculator that will do all of the computing for you, so you do not have to waste your time doing it manually.

Fractional Kelly Criterion Explained

So far, so good. Knowing the precise probability of the event, Kelly strategy will give you a slow incremental pace but making steady, dependable progress in the long run. Unfortunately, regardless of how good your betting prediction model is, where you get your information from, or what is your knowledge related to a particular team or sport your data and probability calculated will always be slightly biased and skewed.

Therefore you should add that into your Kelly criterion formula and decrease the suggested stake and only risk a fraction of it.

Here is the formula to add the adjustment factor:

(((Probability multiplied by odds) – 1) divided by (odds – 1)) multiplied by your chosen fraction

Using the above figure we should end up with the following calculation using a fraction of 30% from the calculated kelly criterion or 0.3:

[ (0.39 * 3 ) – 1 ]/( 3 – 1 ) = [ (0.39 * 3) – 1 ]/2 = [(1.17 – 1)]/2 = 0.17/2 = 0.085 * 0.3 = 0.0255

0.0255 * 100 = 2.55%

Meaning you should risk 2.55% from your entire bankroll, in our case that will be £10 000 * 0.0255 = £255 on Valencia to win.

A lot has been written with regards to how to use Kelly criterion and what is the best fraction to apply. In general terms, you can apply any fraction that makes you feel comfortable and resonates with your risk taste.

The general rule of thumb is that you should never risk more than 2% from your betting bankroll on a single event. Nevertheless, we would not recommend you to place more than 1.5% on a single bet as that will be a little too risky.

If you struggle to understand how exactly to identify the fraction or to do the math yourself feel welcome to use our free and easy to use the Kelly Criterion calculator. Our Kelly Criterion calculator is designed to compute the exact stake and it does take into consideration your preferred fraction.

Reasons to use Kelly Criterion as a bankroll management strategy

As a professional punter, you should always look for a mathematical edge rather than rely solely on impulses. Although there is always going to be subjectivism when deciding which games to bet on, you should follow a strictly defined model of finding and placing your bets if you want to be successful in the long term.

Kelly criterion gives you a solid ground on how much to stake at any given time, considering that you are having an edge over the bookmakers. Of course, like any other model, it has it’s pros and cons, and you should consider both prior adopting Kelly criterion.

Pros of Kelly criterion for sports betting:

- It gives you an optimal betting size according to your bankroll.

- Considering you have an accurate model that gives you a genuine edge over the bookies Kelly strategy provides a very low risk for your bankroll.

- In the long term it increases your winnings exponentially.

- It isn’t too complicated, and everyone can easily understand and follow it.

Cons of Kelly criterion for sports betting:

- This system is mainly used to benefit your bankroll growth, but it doesn’t calculate the probability of the outcome. It requires you to actually win at least ~53% of the outcomes, which is entirely dependable on your skills and knowledge.

- It takes a big number of bets to be entirely useful.

- If you are operating with a really big bankroll (1m+), it ties your hand after a while, because it would require enormous bets on single events that not every bookie provides.

Keeping track of your performance while using Kelly Criterion

As most of the money management strategies, the Kelly Criterion has its specifics. As mentioned above, it is a strategy that works best in the long run and on a high volume of bets. In order to ensure that Kelly is a suitable strategy for you we strongly recommend keeping neat track of your performance.

That will help you to identify whether you are profitable and comfortable with the size of the stakes you use.

Last but not least, you will be able to figure out whether your approach of measuring the real probability of an event happening is correct. Betting.com is a tool that can help you track and analyse your bets in an easy, reliable and quick way.

Similar Betting Models for Football games

Of course, Kelly Criterion money management is not the only staking plan, but it has proofed to be among the most successful once. A lot more strategies were tested during the years. Some failed quickly, while others proved to be successful, at least for a period of time.

We hope you have enjoyed reading this article and we have helped you to improve your betting knowledge. To read more articles like this and have access to a growing community of sports betting enthusiasts feel welcome to join Betting.com for free.